New data reveals Borough of Richmond is amongst most expensive UK areas for first-time buyers

By Heather Nicholls 14th Mar 2024

A new study has revealed the best and worst UK regions for first-time buyers based on house affordability and earning potential.

The study, conducted by free mortgage broker L&C Mortgages, analysed GOV.UK data on median earnings and average first-time buyer house prices per region, revealing the UK areas with the best and worst house price-to-income ratio.

The Borough of Richmond upon Thames, alongside numerous other locations in London fell into the least favourable options for first-time buyers, with low median salaries and staggeringly expensive properties.

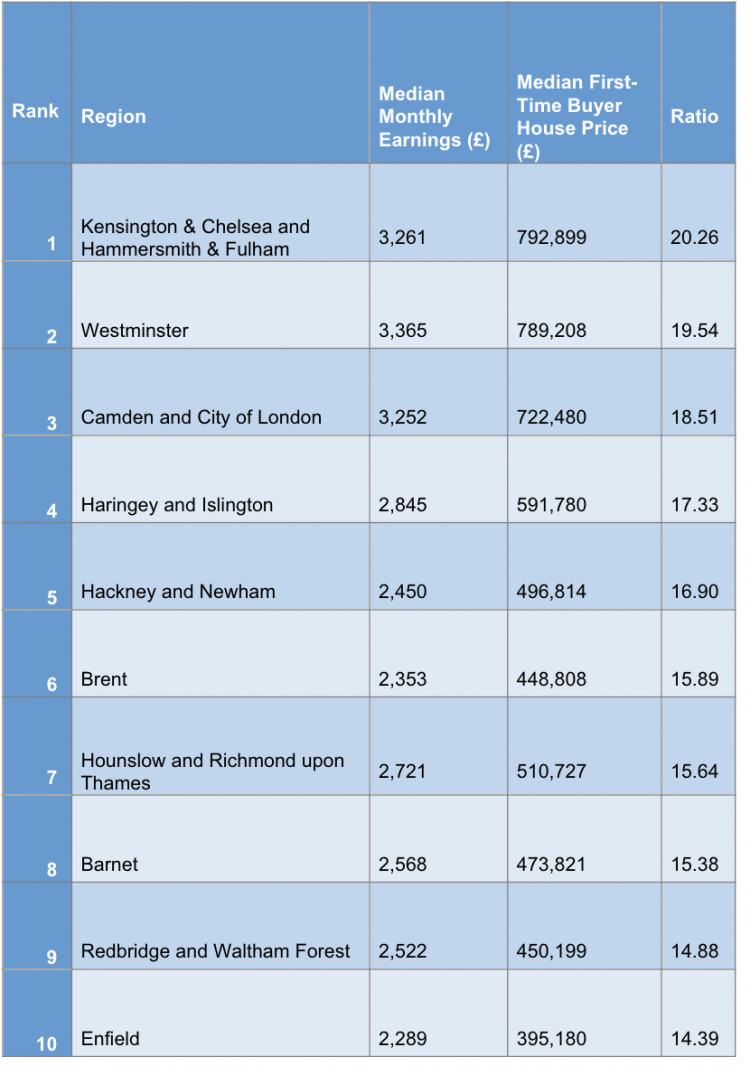

Kensington and Chelsea and Hammersmith and Fulham topped the list as the least cost-effective areas for first-time buyers. The area's median first-time buyer house price was a staggering £792,899, with monthly earnings of just £3,261 – making this the most challenging and inaccessible market for first-time buyers in the UK.

The research revealed that the top ten most expensive areas are all located in London – including Westminster, Camden and City of London, Haringey and Islington, Hackney and Newham, Brent, Hounslow, and Richmond upon Thames, Barnet, Redbridge and Waltham Forest and finally Enfield.

Richmond upon Thames came in as the seventh most expensive area.

Other areas outside of London that rank within the top twenty-five most expensive regions include Brighton and Hove, East Surrey, Buckinghamshire County Council, West Essex, West Kent, West Surrey, and Bristol.

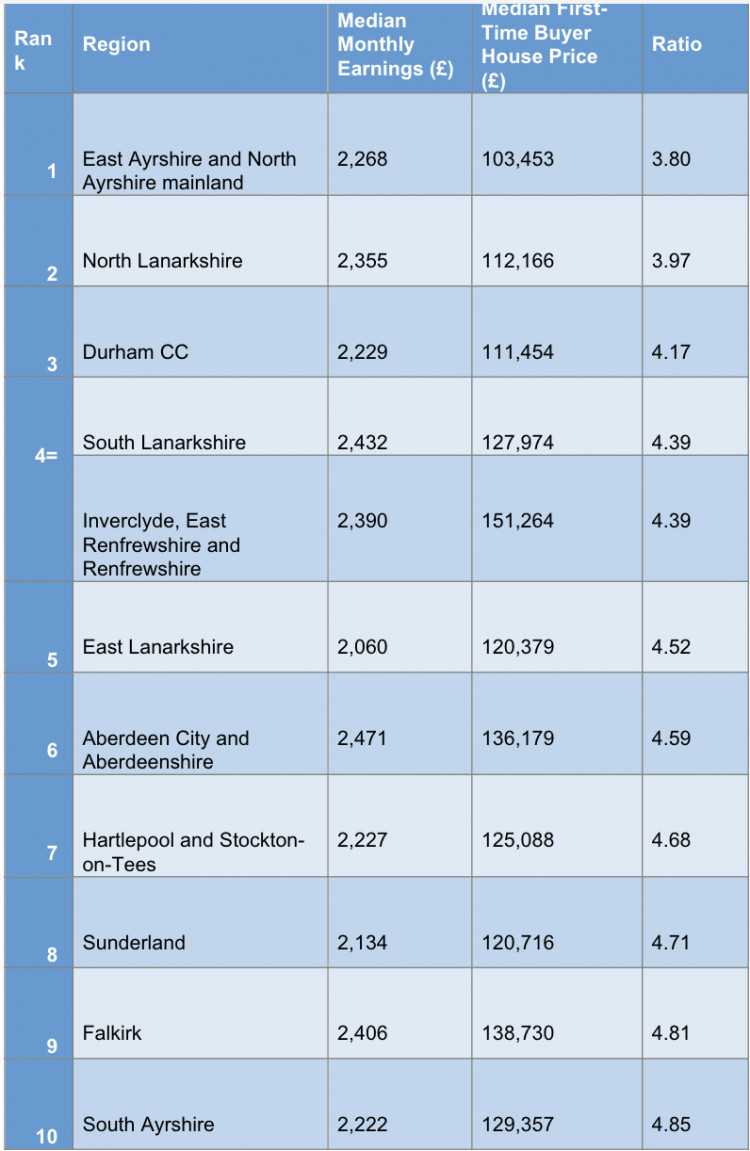

The best area in the UK for first time buyers was East and North Ayrshire, which offers first-time buyers the opportunity to live in an idyllic Scottish town for an affordable price.

The median monthly salary for this area is £2,268, which is only just lower than the UK average of £2,322. Additionally, the area shines with a remarkably low median first-time buyer house price of just £103,453, the lowest in the UK.

Ayrshire's reasonable salary offerings and impressively low first-time buyer house prices give it a ratio of 3.8 – making it the most affordable UK area to buy a house.

Speaking on the findings, an expert from L&C Mortgages says: "As house prices have rapidly increased across the UK in recent years, the affordability challenges have only grown.

"Identifying regions with favourable house-to-income cost ratios shows just how regionalised affordability can be and highlights how some first-time buyers may find it easier to get on the property ladder than others.

"Scotland features high up in the list of areas offering numerous areas with more affordable housing prices when compared to earnings.

"On this metric, it looks to have a solid status as the top UK area for affordability for prospective homeowners."

They added: "Unsurprisingly, London dominated the list of areas where first-time buyers may find it hardest to get on the ladder, highlighting the mismatch between house prices and average earning.

"Additionally, the ranking highlighted the most cost-effective regions in England for first-time buyers were largely to be found in the North East, with Hartlepool, Stockton-on-Tees, and Durham County Council leading the pack.

"That will be welcomed by first-time buyers looking in those areas, and although never easy to get on the ladder, it could at least offer hope to those saving toward their first purchase "

CHECK OUT OUR Jobs Section HERE!

twickenham vacancies updated hourly!

Click here to see more: twickenham jobs

Share: