Richmond MP sounds alarm over mortgage bills

By The Editor 3rd Nov 2022

Home buyers on tracker rate mortgages face an average annual increase of £880 a year after the Bank of England raised the base rate to 3% today.

The increase of 0.75 of a percentage point in the base rate will push up the cost of borrowing, taking money out of people's pockets.

The failed mini-budget of Liz Truss and Kwasi Kwarteng spooked international money markets and pushed up interest rates on borrowing for the government and other institutions.

Separately, the Bank of England is under pressure to use higher interest rates to smother inflation by hitting the borrowing and spending power of consumers.

As it announced the rate rise, Bank documents suggested the UK now faces a recession running through 2023 and in to 2024. There are also predictions of house price falls.

Some economists have argued the idea of raising interest rates now to stifle inflation are wrong and unnecessary as the rate of price growth is already forecast to fall away through 2023.

It is claimed that energy and food price rises have peaked and the UK inflation rate of 10% could well fall to below the target of 2% by the end of next year.

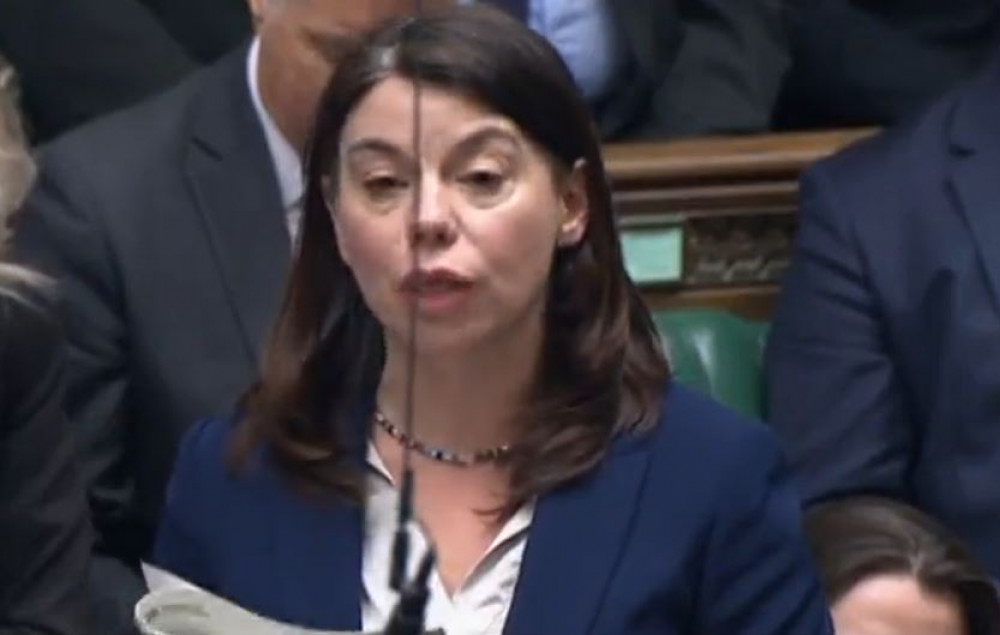

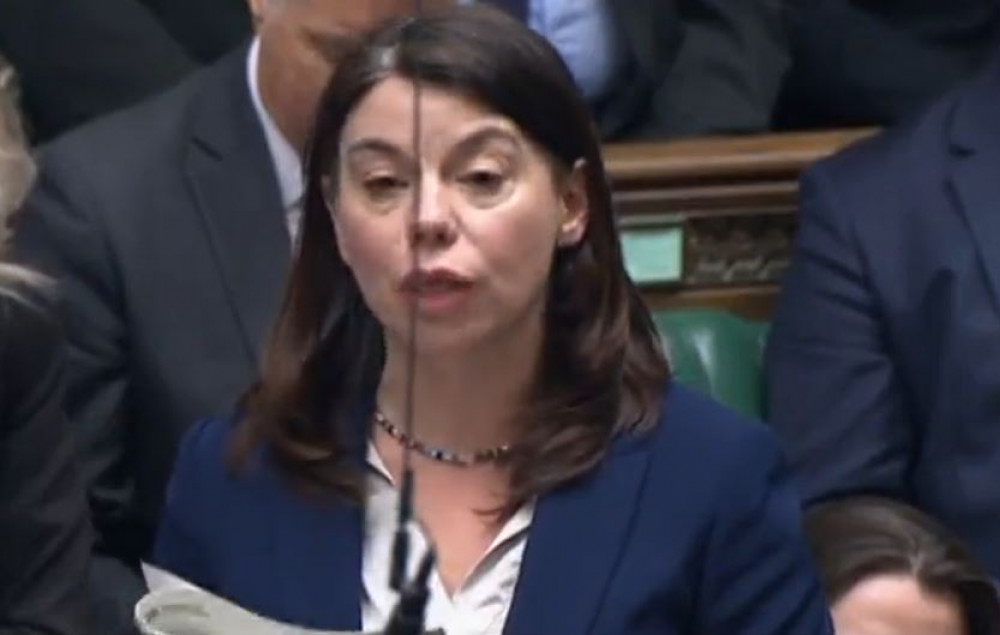

Reacting to today's news, the Richmond Park MP, Sarah Olney said: "This rate rise will be devastating to millions of mortgage holders across Britain.

"The blame lies solely with this Conservative Government, whose economic mismanagement is going to leave hard working families picking up the tab."

CHECK OUT OUR Jobs Section HERE!

twickenham vacancies updated hourly!

Click here to see more: twickenham jobs

Share: